intropia

Jul 1, 2022

insights & overviews

7 Tips from OGs to Survive the Crypto Winter

Crypto markets often resemble an exhilarating rollercoaster ride. A popular theory suggests that these wild fluctuations are instigated by Bitcoin halvings, but not everyone agrees. What remains indisputable is the cyclical nature of markets, with bear markets being a recurring phenomenon.

Source: Kevin Owocki

Interestingly, bear markets play a crucial role in fostering industry growth. They effectively distinguish between short-term opportunists and committed long-term builders.

Newcomers to the crypto sphere within the last two to three years might be apprehensive about the industry's future prospects. Yet, long-term participants (5-10 years) remain unflustered, focusing solely on their work. Some even crave the tranquility of bear markets, which allows them to build in peace.

Hence, bear markets present an opportune moment to glean advice from crypto veterans. In this piece, we'll delve into insights from the founder of intropia, Max Uper, and several Web3 pioneers, some having been a part of the sector since 2011.

This piece zeroes in on how Web3 contributors can withstand bearish crypto cycles. In the subsequent piece, we'll reveal how startup founders weather and thrive amidst bear markets. Stay tuned for that!

Keep BUIDLing

“Don’t trade or look at the charts. Just build, hustle and raise.”

Ivan, Crypto OG since 2011 & Founder of LotsofLands

Seasoned crypto players (OGs) often perceive bear markets as blessings in disguise. When the hustle-bustle quietens down, true builders continue to forge ahead.

Such periods often witness the birth of revolutionary products, with teams adept at treasury management surviving and succeeding.

Products that demonstrate use-cases and market fit during bear markets often prosper in the long run.

Powerful tools like Compound or Aave only came into being during a bear market, sparking off a DeFi revolution that catalyzed the subsequent bull cycle.

Oleg Kudrenko, the CTO of Pyrpose and a former team lead at CEX.io, advises abandoning expectations of an immediate market reversal and strategizing accordingly.

Community as your lifeboat

Bear markets can impact even seasoned investors' mental well-being. The continuous price dips can be taxing.

Keeping a positive outlook may sound simplistic but finding solace within a supportive community can help weather the storm.

Becoming part of communities with shared interests prevents feelings of isolation. The mutual support can help navigate bear markets effectively.

Bear markets also offer an excellent chance to forge relationships that will prove beneficial in future ventures.

Andriy Velykyy, co-founder, and CEO of Allbridge suggests "Seek out education and like-minded individuals. Once the bear market ends, you'll be ready to launch a unicorn together."

Joining a Discord channel or attending relevant events or conferences can lead to building a strong network. You might consider starting with the list of crypto / Web3 events provided by intropia.

Choose a radical path

Extreme situations often necessitate extreme actions. Opt for an ultra-conservative or ultra-radical approach. While it may seem contentious, this strategy can be the most rewarding way to tackle a bear market.

The conservative path involves joining an established company to weather the storm.

The radical path means signing up with a team working on an audacious, high-potential project, often led by eccentric developers. While the ride may be rocky, the thrill of building something disruptive may overshadow the bear market's gloom. And the potential returns in the subsequent bull cycle could be astronomical.

Alternatively, balancing both paths could involve joining an established company while contributing to a moonshot project in your spare time.

Focus on financial resilience

One of the first things you need to do is start stocking up on instant noodles and cut down the flights on the private jet. Just kidding:)

The primary measure during a bear market involves reducing extravagant expenditures and managing resources judiciously. The fuel you save during the bear phase will provide the runway needed for the bull phase.

Andriy says it clearly: “Analyze your expenditures: drinking champagne on the New York Rooftops may not be a good idea, instead go for a beer at the beach.”

Avoid locking yourself in illiquid assets (like NFTs or non-valuable cryptocurrencies) and establish a reliable income source independent of market conditions. Having surplus capital will enable you to buy assets at discounted rates during the bear phase.

Nike Long, the founder of CryptoAlco, offers this advice during a bear market: "Remember, this too shall pass".

“As in the real world, in the crypto world, the main goal is to survive. Save your funds. Take care of your project. Survivors of past crypto winters have been generously rewarded by the market for having endurance. The industry is growing and evolving, so there is a non-zero chance that you will be rewarded again in the future. Just survive.”

Stay alert for alpha

The Web3 often feels like the Wild West. Navigating through it requires adeptness, even during a bull market. Learning to avoid potential pitfalls while forging beneficial alliances is key.

Bear markets provide an opportune time to explore and experiment with Web3 projects. With reduced hype, you can carefully evaluate the potential and authenticity of different projects.

Exploring various projects can yield surprising rewards. An example would be the ENS airdrop, which rewarded early ENS domain registrants handsomely.

During the previous cycle, intropia's founder Max Uper remained actively involved, simultaneously building a Web2 recruitment business (Make It In Ukraine) to maintain a steady income. This dual strategy led to his company scaling almost twofold in 2021 and gave him invaluable expertise in Web3 HR, forming the backbone of intropia.

Investing in projects run by trustworthy friends or gaining access to high-potential projects seeking funding can be profitable. Max consistently invests, learns, and researches new projects to prepare for the next bull run.

And who knows? While doing your own research, you might stumble upon other opportunities to contribute during the bear phase.

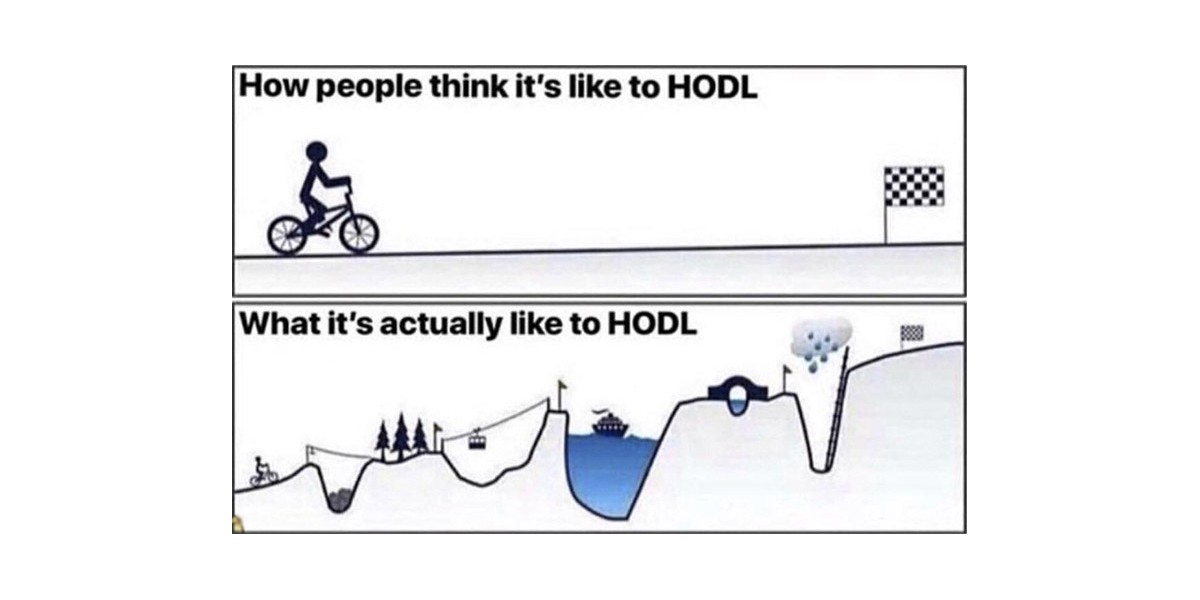

Make wise use of time

Time equals money, so make sure to use yours wisely. Instead of obsessing over plunging market charts, use this period to enhance your skills.

Learning about emerging topics like zkRollups or Layer2s can keep you ahead of the curve. The crypto space is continually evolving, and you wouldn't want to miss the next big shift.

Taking a break from crypto is perfectly acceptable. Spend time developing new skills like copywriting, on-chain analytics, or game theory. You could also take a short break, cultivate good habits, or pursue a hobby.

Andriy suggests sports, healthy eating, spending quality time with loved ones, and reading good books to avoid burnout and keep morale high.

Positivity sparks change

Falling into the habit of incessant doomscrolling can happen to anyone, especially in times of a market crash. If you find yourself trapped in this cycle, take a moment to reorient yourself. Negative thinking can lead to disastrous outcomes.

Maintaining a positive outlook in a challenging environment can be a test of mental fortitude. However, it's worth it. Positivity breeds resilience, which can propel you towards your goals and inspire others along the way.

Strive to be realistic, not naive or cynical. A positive attitude and supportive nature can become your superpowers, helping you and your community overcome any obstacle.

Andriy advises, "Don't panic or pay heed to naysayers proclaiming the end of crypto. We are witnessing a cyclical pattern; a rise will follow the current dip."

Nike adds, "There will always be naysayers. The key is knowing why you're in crypto."

intropia stands by you

intropia is committed to seeing you succeed in both favorable and challenging times. We hope the guidance provided above will help you navigate the crypto winter.

Our goal is to create a community-owned talent platform that aids in exploring the vast Web3 landscape and earning crypto through job sharing with friends and followers.

Early testers of Intropia's Share & Earn and Refer & Earn programs have a high chance of securing a place for the Genesis NFT mint.

intropia's Genesis NFT is about rewarding our earliest and most steadfast supporters who wish to see this community thrive in the long run. They view intropia as a trusted haven for Web3 opportunities.

You're not alone in this journey. One of the simplest ways to initiate positive change is by joining our community. Join our Discord and let's discuss how we can support you.

How to engage with intropia

Now's the time to join the excitement! intropia is a community-driven recruitment platform, and we delight in rewarding early adopters. Here's how you can join us:

Join our Discord and get started

Follow us on Twitter and activate notifications

Explore Quest Board for top Web3 opportunities

Fill this form to list your organization's opportunities with us and reach the best talent in Web3

Subscribe to our Newsletter for the latest Web3 opportunities and insights

Talent matchmaking

platform in Web3